SECOND QUARTER 2025

Letter to Investors

September 8, 2025

My fellow investors,

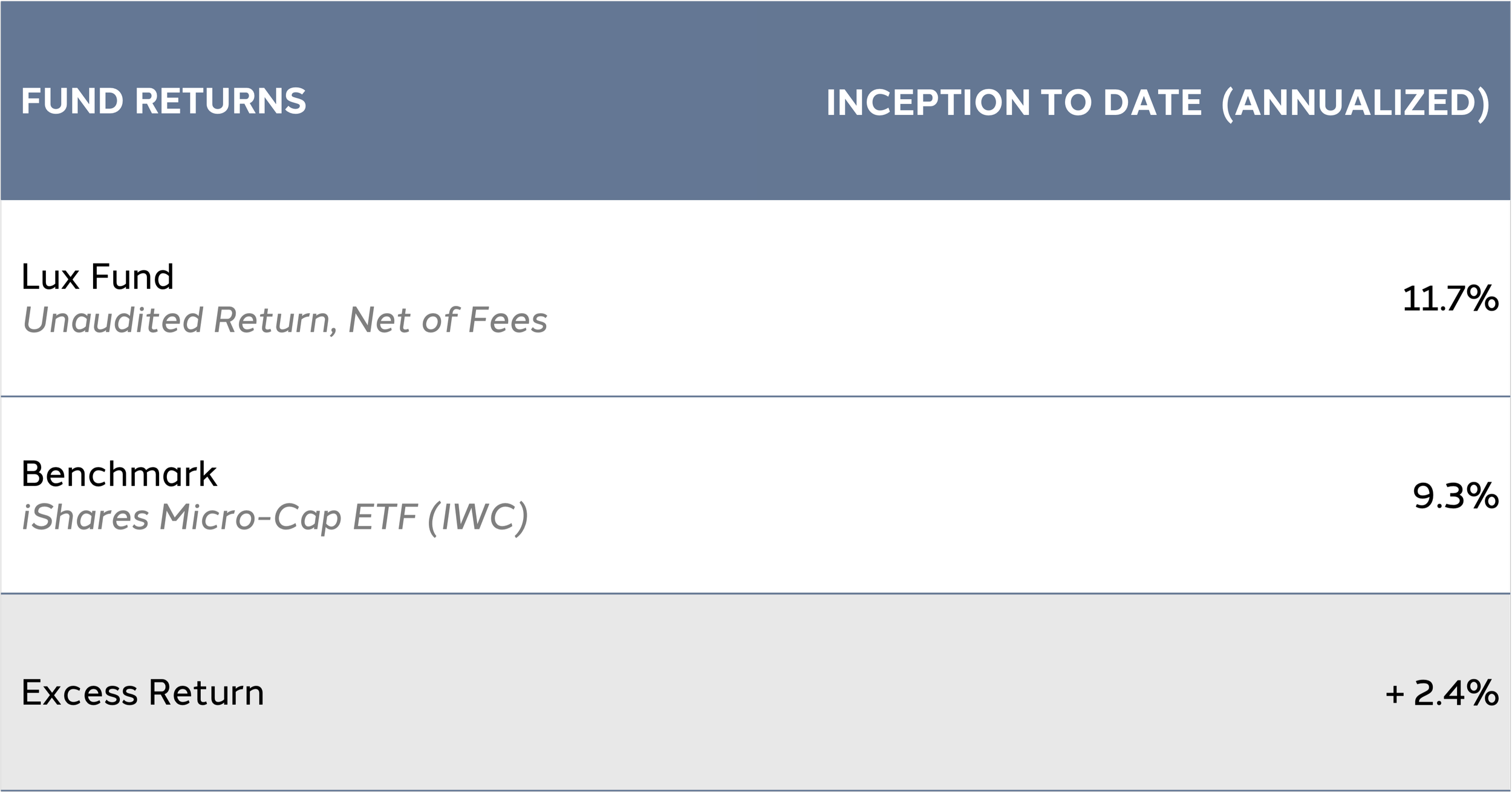

Gurnee Group Lux Fund reached its two-year anniversary at the close of the second quarter. Since inception, Lux Fund has achieved an 11.7% annualized return and an excess return of 2.4% per annum (net of fees, unaudited, compared with the iShares Micro-Cap ETF benchmark).

We hope that delivering on our objectives—to grow your total portfolio, with a unique and diversifying investment tool—reinforces your confidence in Lux Fund.

The equity market rebounded sharply in the second quarter following the selloff related to uncertainty in global trade policy in the first quarter. Quantum computing and next generation aviation stocks, with minimal revenue and significant cash burn, appreciated considerably. Lux Fund’s intentionally modest allocation to such nascent companies limited the Fund’s participation in the recovery. Our process emphasizes investing in profitable businesses at valuations that permit future appreciation, which we believe will result in long lasting success for our investors. To this end, Lux Fund was active during the quarter, initiating 15 new investments (please see position changes for more details). Our portfolio holdings are growing cash flows and are implementing strategies to accelerate their future growth which, historically, has led to increasing valuations (please see portfolio outlook for more details).

“We believe we have entered a time of disruption where artificial intelligence has the potential to impact every industry and business model in the economy.”

Our conviction in investing in small, high-quality businesses remains as strong as ever. Families and organizations that include micro cap public equities in their portfolios gain the benefit of unique diversification and the potential upside opportunities of smaller companies. Historically, a 20% actively managed allocation to micro cap public equities has contributed as much as 40% of overall portfolio returns.

In addition to delivering impactful products for our investors, we are committed to creating a great client experience. For clients who have not yet reached their optimal Lux Fund allocation—or who wish to rebalance as their wealth grows—we now offer the ability to set up automatic contributions, and the flexibility to adjust contribution levels on a monthly basis. Should this be of interest, we’d be glad to help you enroll.

It’s a privilege to have your trust in Gurnee Group and we thank you for your participation in Lux Fund.

Sincerely,

J.P. Gurnee, CFA

Portfolio Manager

jp@gurneegroup.com | 989.513.0082

-

Portfolio Outlook

Our portfolio holdings are growing cash flows and are implementing strategies to accelerate their future growth which, historically, has led to increasing valuations.

-

Position Changes

Our investment process emphasizes investing in profitable businesses at valuations that permit future appreciation, which we believe will result in long lasting success for our investors. To this end, Lux Fund was active during the quarter, initiating 15 new investments.

-

Performance Summary

View quarterly results including returns, top contributors and detractors, and portfolio characteristics.

Portfolio Outlook

Lux Fund benefits from quantitative tools that apply the findings of University of Chicago scholars Fama and French. They discovered that over time, stocks of companies that are relatively small, inexpensive and profitable outperform stocks of companies that are relatively large, expensive and less profitable. We believe these findings will continue to hold true going forward. Lux Fund pairs Fama and French’s findings with additional proprietary characteristics we’ve internally established through our own quantitative studies.

Our investment process further pairs these quantitative insights and tools with qualitative review. This is critical in periods of disruption, where a business’ future may diverge materially from its past. We believe we have entered a time of disruption where artificial intelligence has the potential to impact every industry and business model in the economy.

Qualitatively, we assess each investment by weighing the possible outcomes of disruption against the market’s implied outlook, as expressed in current valuation. We are most enthusiastic about profitable companies positioned to gain from disruption that remain overlooked by investors. We believe these situations offer a rare combination of downside protection and substantial upside.

ACTIVE ILLUSTRATIONS OF OUR INVESTMENT PROCESS

Below, we share three live examples of how we approach secular investing in the context of our repeatable, evidence-based investment process. Each example company has a strong base of revenues and earnings that limits the investment downside from today’s valuation. We also believe each has the potential to accelerate growth through capitalizing on the current technological disruption cycle. Lux Fund owns these stocks as part of its diversified portfolio.

-

Aehr Test Systems

As a provider of semiconductor test and burn-in solutions, outsized growth could come from the company enhancing chip reliability in support of new AI and electronic vehicle industry use cases.

-

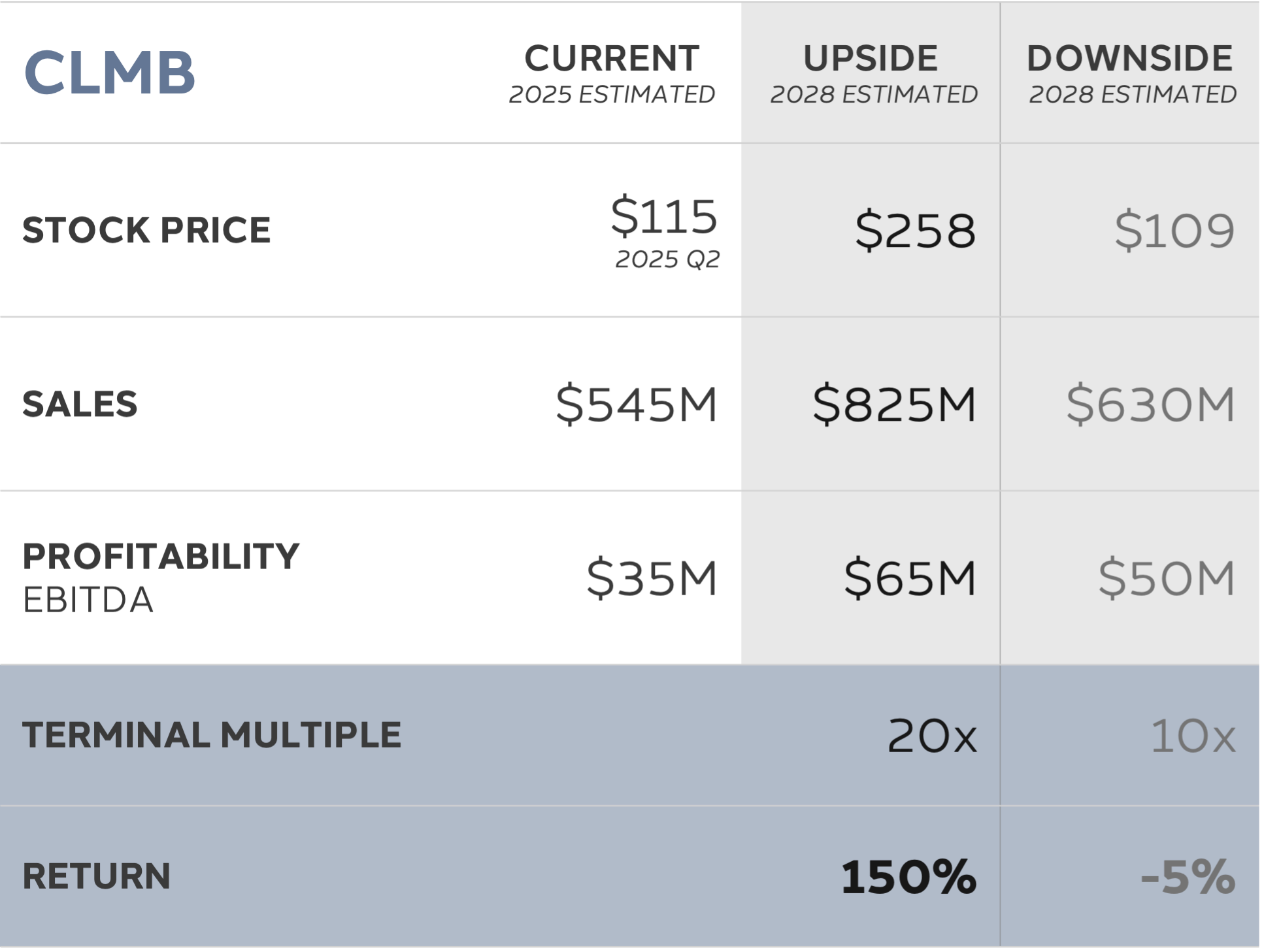

Climb Global Solutions

As a distributor of emerging software, accelerating growth could come from the company adding emerging AI solutions to its vendor portfolio.

-

SkyWater Technology

As a domestic semiconductor foundry, increased growth could come from serving quantum computing partners, namely D-Wave Quantum, which has been a partner of SkyWater since 2013, as well as the US government seeking secure, scalable, and U.S.-based production.

ARTIFICIAL INTELLIGENCE COMPANIES WITH HIGH VALUATIONS

During the second quarter, equity markets priced the stocks of companies that deal directly in quantum computing at significant premiums which we believe limits their future appreciation opportunity.

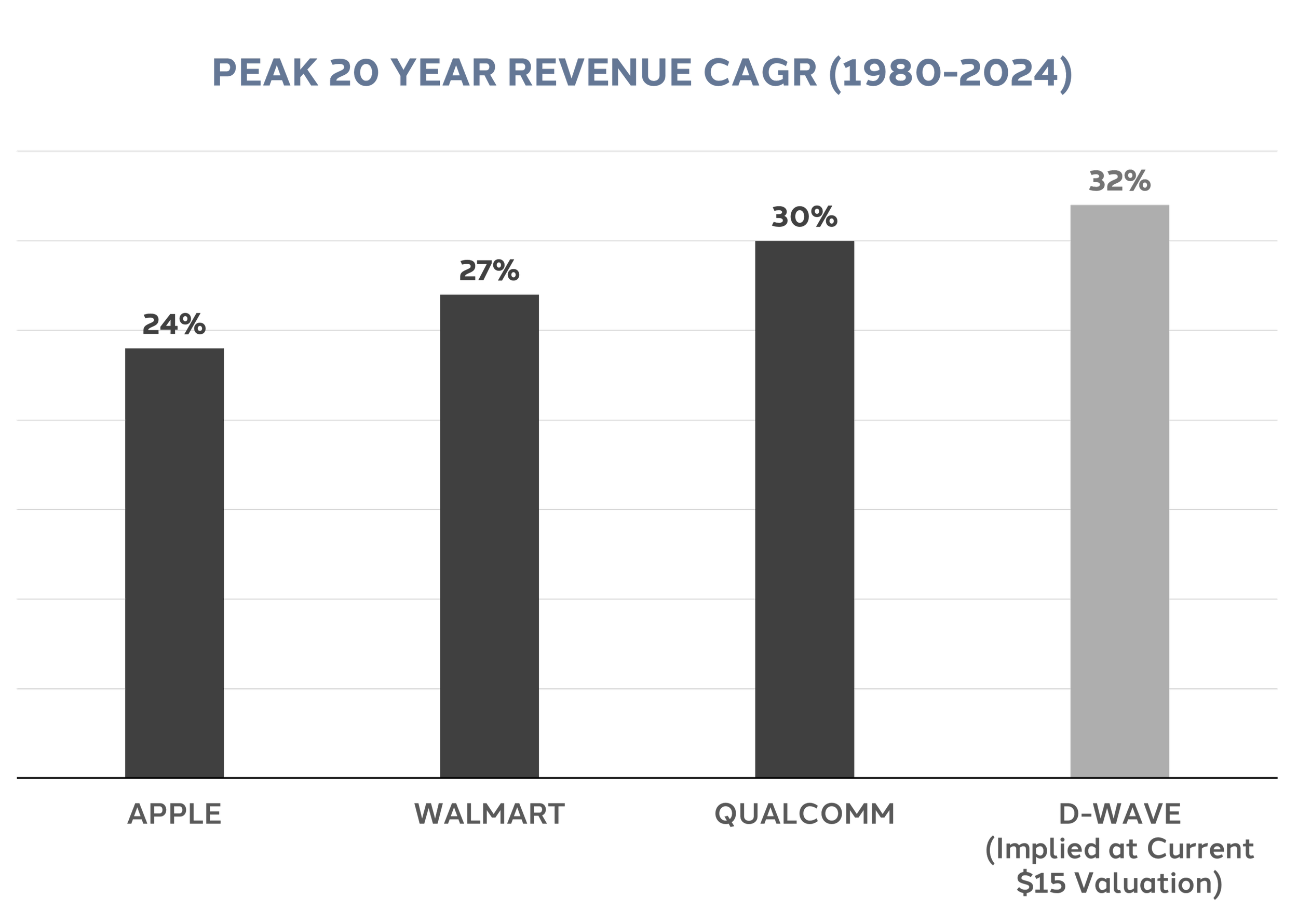

For example, D-Wave Quantum appreciated from a valuation of ~$500M to $6B+ during the second quarter. Looking forward, in order for D-Wave Quantum stock to outperform the historical 7% annual equity market return for the next twenty years, the company’s market capitalization must increase from $6B to $20B. Assuming a 20x terminal price to earnings valuation and Nvidia’s margin profile, the company would need to generate revenues of $6B and earnings of $1B in 2045. This means the company must deliver revenue growth of 32% each year for the next 20 years.

We studied the revenue growth of every company in the public equity market over the last 44 years (1980-2024) and found that less than 1% of all companies (107 instances / 13,078 observations) were able to achieve revenue growth of 32% over a consecutive 20 year period. Notably, Apple, AMD and Qualcomm were unable to achieve this feat.

Perhaps D-Wave Quantum will achieve success; however, should it come up short versus the stock market’s implied expectations for 32% annual growth over the next 20 years, we believe the stock will not prove to be a worthy investment.

We see promise in quantum computing, though historical data suggest that D-Wave growing 32% per annum for 20 years straight is statistically unlikely. Even if it does play out, that would only justify a 7% annual return in the stock over the next 20 years. We prefer investments in companies like SkyWater Technology, which ironically, is partnered with D-Wave and should directly benefit from quantum computing growth, yet is not valued accordingly in our view.

Position Changes

This quarter, several Lux Fund holdings received acquisition offers, prompting us to exit those positions. These outcomes highlight our ability to invest at discounted valuations and realize gains as intrinsic value is recognized.

-

New positions are initiated in the fund when they are attractive per LuxβetaTM (quantitative review) and validated through LuxαlphaTM (qualitative analysis). The fund initiated new positions in the following companies during the quarter:

APOGEE ENTERPRISES

CODA OCTOPUS GROUP

FONAR

FULGENT GENETICS

IMMUCELL

MYRIAD GENETICS

NERDWALLET

PDF SOLUTIONS

RESEARCH SOLUTIONS

SIGA TECHNOLOGIES

SIMILARWEB

SKYWATER TECHNOLOGY

RXSIGHT

TRANSCAT

VIRCO MANUFACTURING

-

Positions are sold from the fund when their LuxβetaTM profile deteriorates, the company develops significant off model, appreciates out of the micro cap asset class, or the company is acquired. The fund sold positions in the following companies during the quarter:

BUILD-A-BEAR WORKSHOP

CANTALOUPE (received acquisition offer)

DOCGO

ENERGY SERVICES OF AMERICA

EVENTBRITE

LENSAR (received acquisition offer)

LIFEMD

METALLUS

RED VIOLET

SPARTANNASH (received acquisition offer)

TILE SHOP HOLDINGS

Performance Summary

Returns

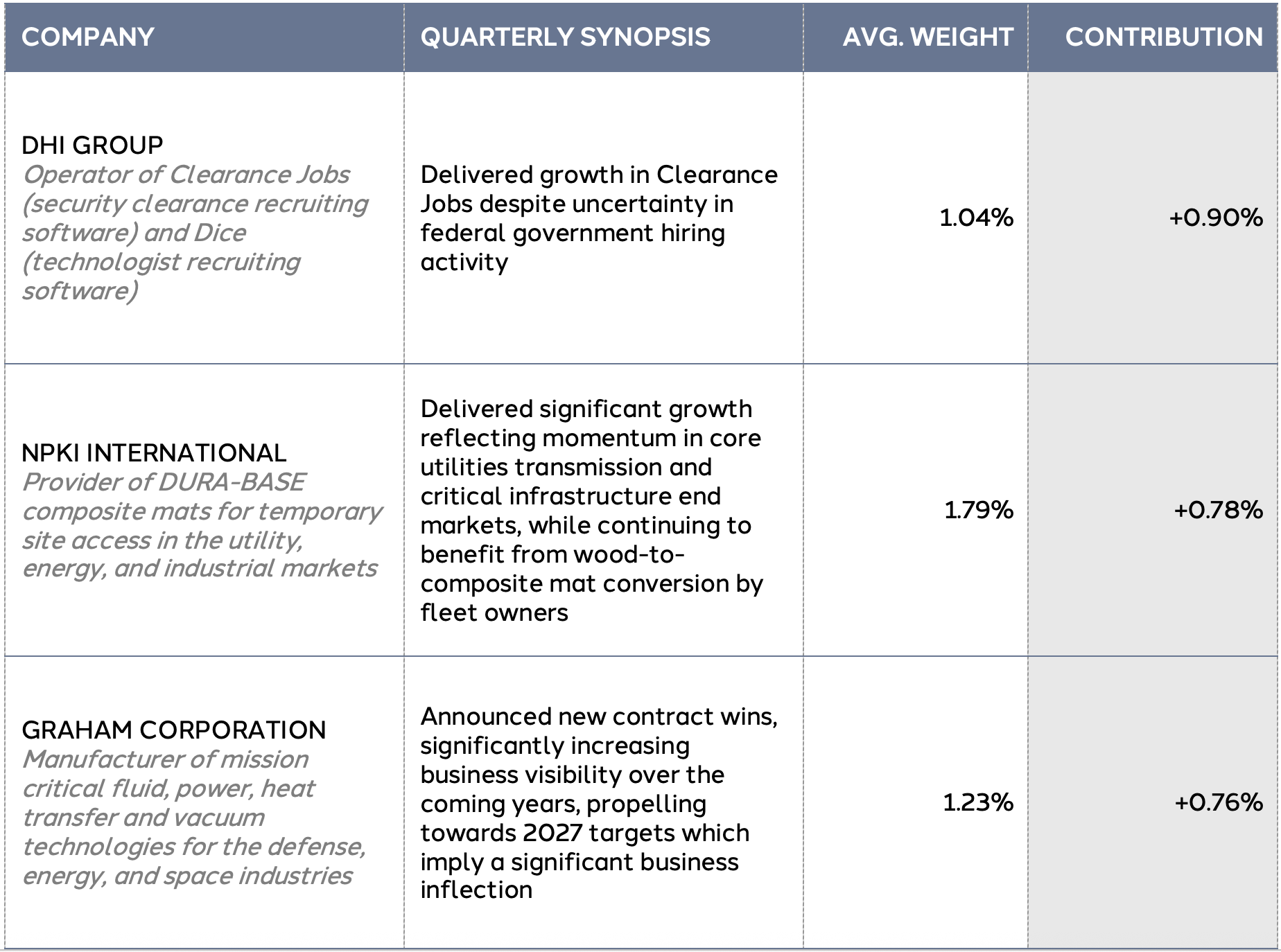

Top Contributors

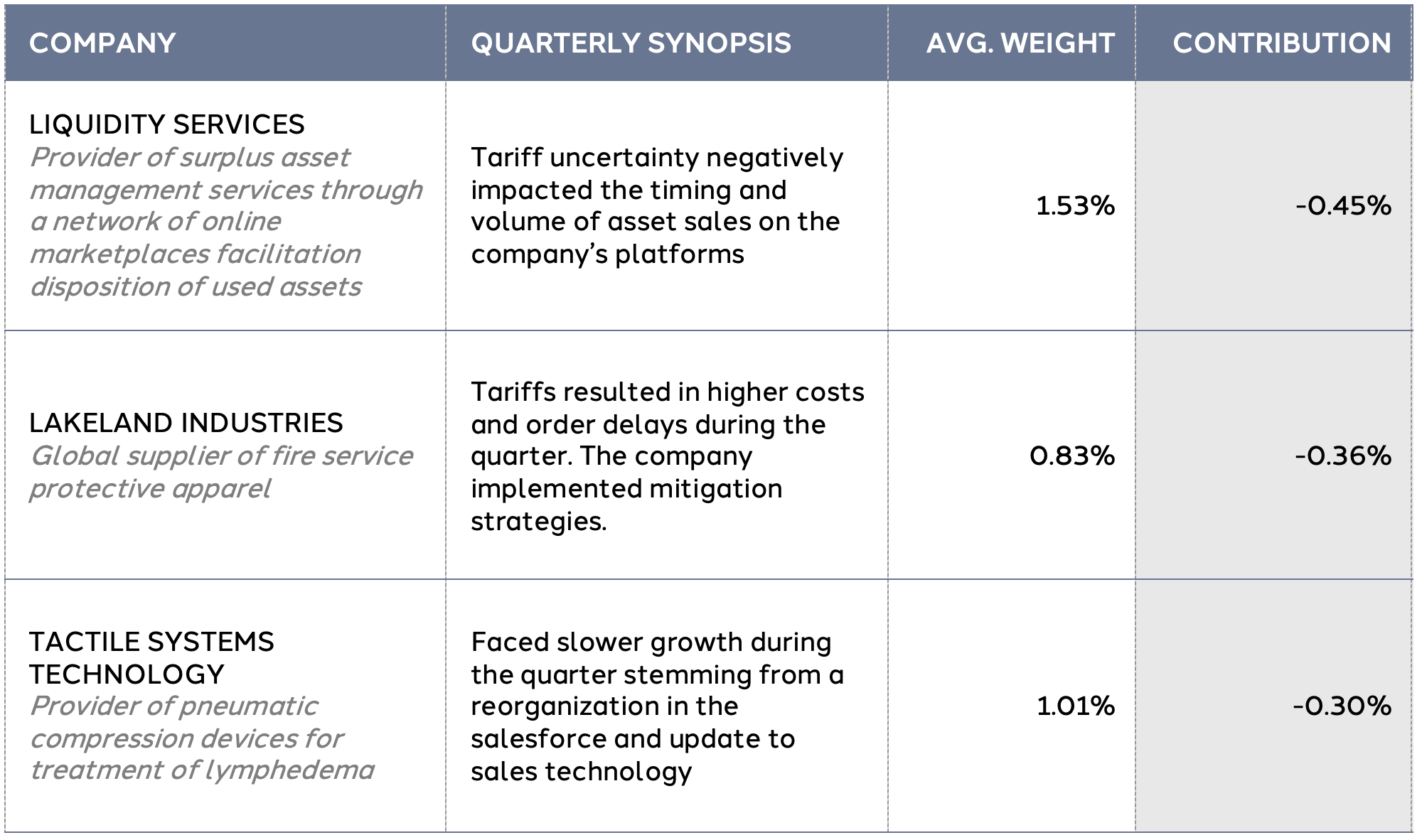

Top Detractors

Portfolio Characteristics

Top 10 Holdings

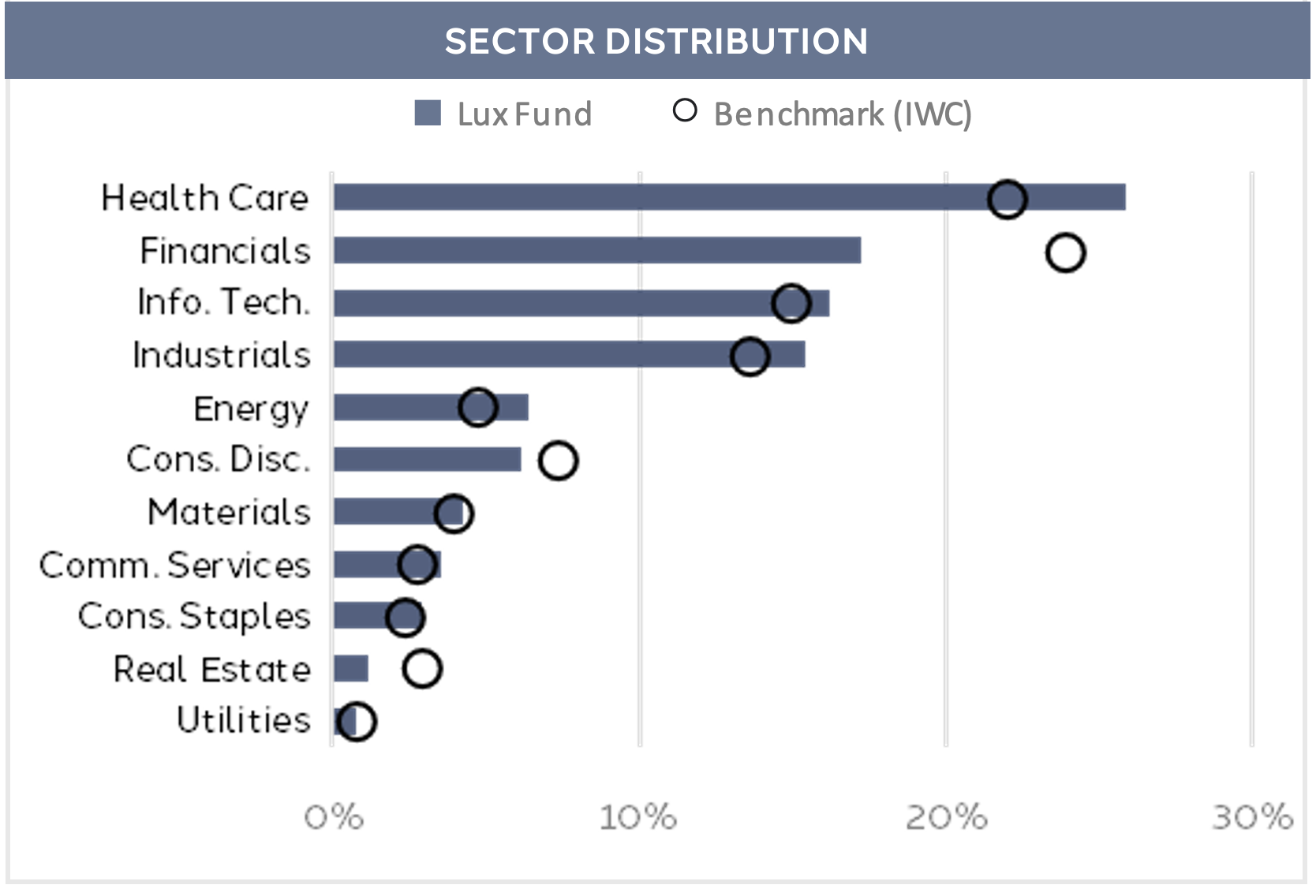

Sector Distribution

Let’s keep in touch.

ⁱUnaudited return net of fees.

Gurnee Group, LLC (the “General Partner”) is not registered as an investment adviser with the Securities and Exchange Commission. However, the General Partner is registered as an investment adviser with the Department of Commerce of the State of Ohio. The limited partnership interests (the “Interests”) in Gurnee Group Lux Fund, LP (the “Fund”), are offered under a separate private offering memorandum (the “Offering Memorandum”), have not been registered under the Securities Act of 1933, as amended (the “Securities Act"), nor any state's securities laws, and are sold for investment only pursuant to an exemption from registration with the SEC and in compliance with any applicable state or other securities laws. Interests are subject to restrictions on transferability and resale and may not be transferred or resold except as permitted under the Securities Act and applicable state securities laws. Investors should be aware that they could be required to bear the financial risks of this investment for an indefinite period of time.

This presentation is being furnished to you on a CONFIDENTIAL basis to provide preliminary summary information regarding an investment in the Fund managed by the General Partner and may not be used for any other purpose. Any reproduction or distribution of this presentation or accompanying materials, if any, in whole or in part, or the divulgence of any of its contents is prohibited. The information set forth herein does not purport to be complete and no obligation to update or otherwise revise such information is being assumed. It is meant to be read in conjunction with the Offering Memorandum prepared in connection herewith, and does not constitute an offer to sell, or a solicitation of an offer to buy, by anyone in any jurisdiction in which such an offer or solicitation is not authorized or in which the making of such an offer or solicitation would be unlawful. The information contained herein does not purport to contain all of the information that may be required to evaluate an investment in the Fund. The information herein is qualified in its entirety by reference to the Offering Memorandum, including, without limitation, the risk factors therein.

A prospective investor should only commit to an investment in the Fund if such prospective investor understands the nature of the investment and can bear the economic risk of such investment. THE FUND IS SPECULATIVE AND INVOLVES A HIGH DEGREE OF RISK. The Fund may lack diversification, thereby increasing the risk of loss. The Fund's performance may be volatile. There can be no guarantee that the Fund's investment objectives will be achieved, and the investment results may vary substantially from year to year or even from month to month. AS A RESULT, AN INVESTOR COULD LOSE ALL OR A SUBSTANTIAL AMOUNT OF ITS INVESTMENT. In addition, the Fund's fees and expenses may offset its profits. There are restrictions on withdrawing and transferring interests from the Fund. In making an investment decision, you must rely on your own examination of the Fund and the terms of the Offering Memorandum and such other information provided by the General Partner to you and your tax, legal, accounting or other advisors. The information herein is not intended to provide, and should not be relied upon for, accounting, legal, or tax advice or investment recommendations. You should consult your tax, legal, accounting or other advisors about the matters discussed herein. The Fund's ability to achieve its investment objectives may be affected by a variety of risks not discussed herein. Please refer to the Offering Memorandum for additional information regarding risks and conflicts of interest.

No representations or warranties of any kind are made or intended, and none should be inferred, with respect to the economic return or the tax consequences from an investment in the Fund. No assurance can be given that existing laws will not be changed or interpreted adversely. Prospective investors are not to construe this presentation as legal or tax advice. Each investor should consult his or its own counsel and accountant for advice concerning the various legal, tax, ERISA and economic matters concerning his or its investment.

No person other than the General Partner, and its Principal, has been authorized to make representations, or give any information, with respect to these membership interests, except the information contained herein, and any information or representation not expressly contained herein or otherwise supplied by the Principal in writing must not be relied upon as having been authorized by the General Partner or any of its members. Any further distribution or reproduction of these materials, in whole or in part, or the divulgence of any of its contents, is prohibited.

An investment in the Fund has not been approved by any U.S. federal or state securities commission or any other governmental or regulatory authority. Furthermore, the foregoing authorities have not passed upon the accuracy, or determined the adequacy, of this document, the Offering Memorandum or limited partnership agreement associated with the Fund. Any representation to the contrary is unlawful.

Certain information contained in this document constitutes “forward-looking statements” which can be identified by use of forward-looking terminology such as “may,” “will,” “target,” “should,” “expect,” “attempt,” “anticipate,” “project,” “estimate,” “intend,” “seek,” “continue,” or “believe” or the negatives thereof or other variations thereon or comparable terminology. Due to the various risks and uncertainties, actual events or results in the actual performance of the Fund may differ materially from those reflected or contemplated in such forward-looking statements. The General Partner is the source for all graphs and charts, unless otherwise noted.

This document may present past performance data regarding prior/other investments, funds, and/or trading accounts managed by the General Partner and/or the Principal. This is presented solely for explanatory purposes. The Fund may face risks not previously experienced or anticipated by the General Partner and/or Principal, and therefore, prospective investors should evaluate the Fund on its own merits. Furthermore, there is no guarantee the General Partner and/or Principal will be able to replicate the mandate, strategy, portfolio construction and risk management parameters reflected in their prior performance data. Market factors and unforeseen circumstances both internally and externally may result in a wide deviation from the returns reflected in the prior performance data, and there is no guarantee the General Partner and/or Principal will be able to avoid and/or remediate such internal and external factors.

Furthermore no representation or warranty can be given that the estimates, opinions or assumptions made herein will prove to be accurate. Any such estimates, opinions or assumptions should be considered speculative and are qualified in their entirety by the information and risks disclosed in the Offering Memorandum. The assumptions and facts upon which any estimates or opinions herein are based are subject to variations that may arise as future events actually occur. There is no assurance that actual events will correspond with the assumptions. Potential investors are advised to consult with their tax and business advisors concerning the validity and reasonableness of the factual, accounting and tax assumptions. Neither the General Partner nor any other person or entity makes any representations or warranty as to the future profitability of the Fund.

PAST PERFORMANCE IS NOT INDICATIVE OR A GUARANTEE OF FUTURE RESULTS.

This document may also present “sample holdings” or “case studies” of a type of asset(s) the Fund may invest in or are expected to be typical of its holdings. Such “sample holdings” are not currently holdings of the Fund and are presented solely for explanatory purposes. Prospective Investors should not assume that such “sample holdings” will actually be purchased by the Fund when determining whether to make an investment in the Fund.